Income Tax Map Europe – The scale is used for calculating your tax. He is progressive. It includes multiple income brackets, which each correspond to a different tax rate, which varies from 0% to 45%. Tax scale To apply . Want to know how your income tax is calculated? The gross tax is calculated on the basis of a progressive scale. This amount is adjusted (cap, discount) to determine the net tax payable. .

Income Tax Map Europe

Source : taxfoundation.org

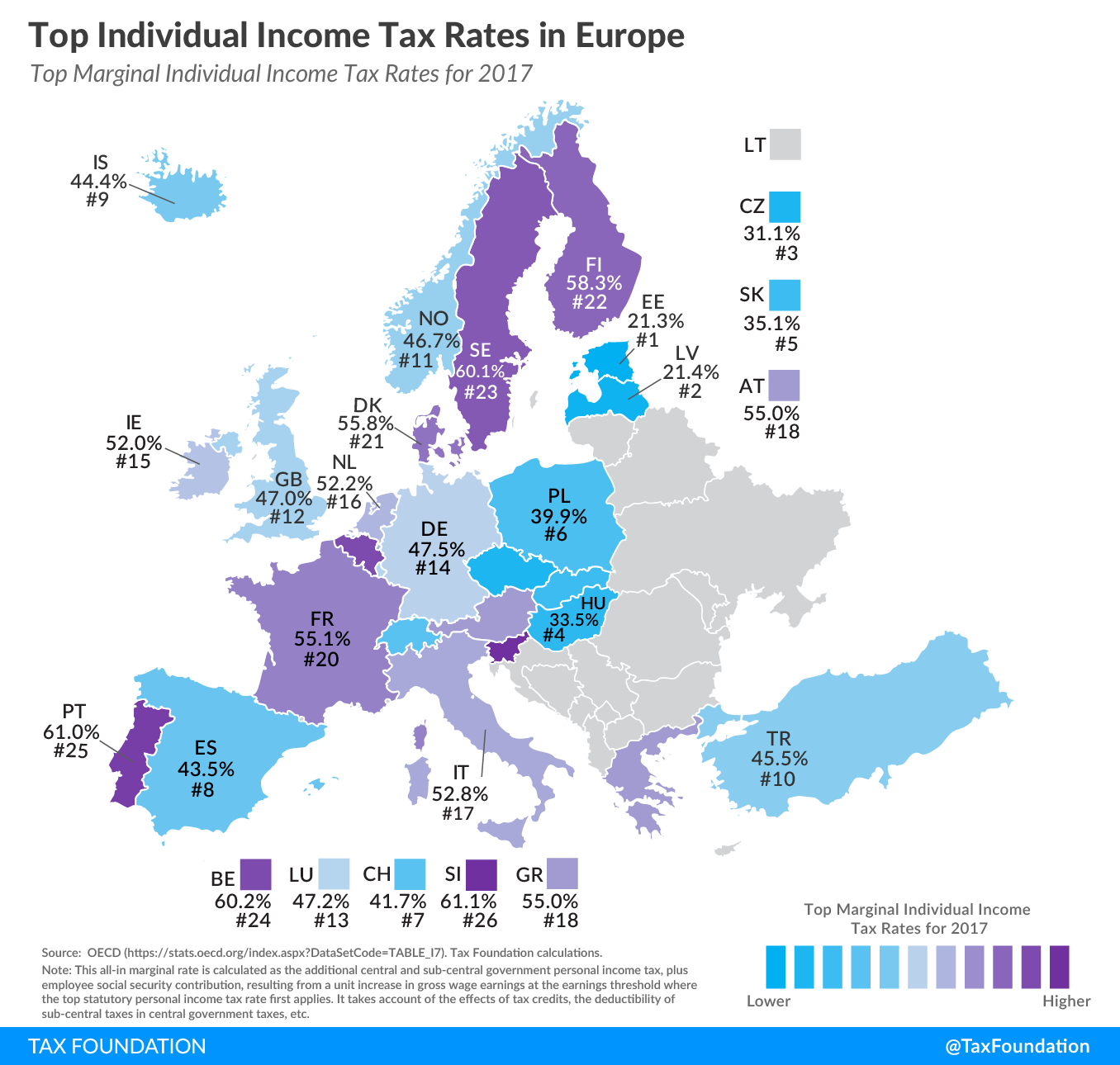

Top Individual Income Tax Rates in Europe | Tax Foundation

Source : taxfoundation.org

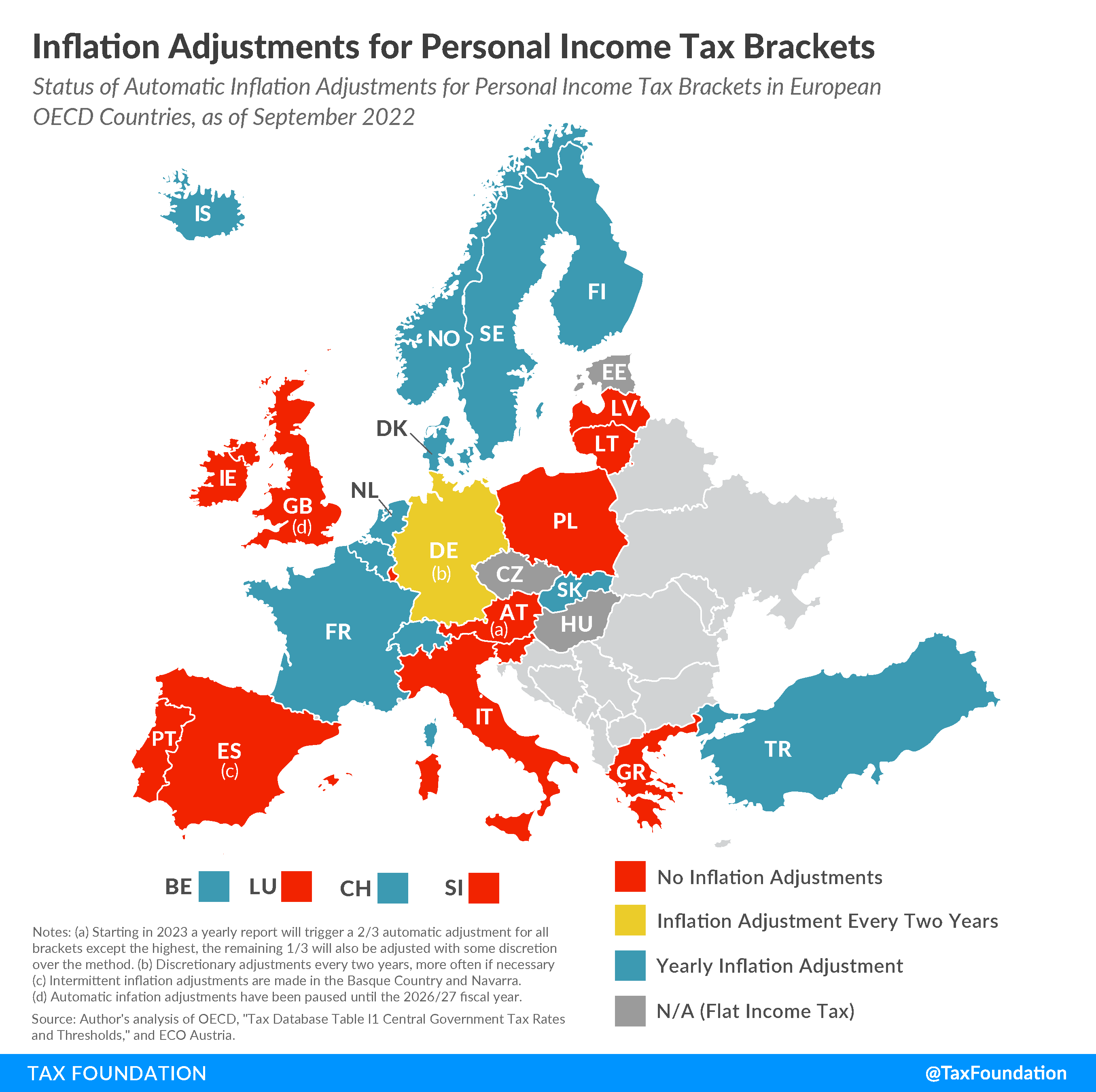

Income Tax Inflation Adjustments in Europe | Tax Foundation

Source : taxfoundation.org

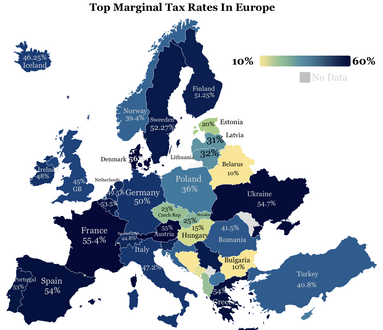

Tax rates in Europe Wikipedia

Source : en.wikipedia.org

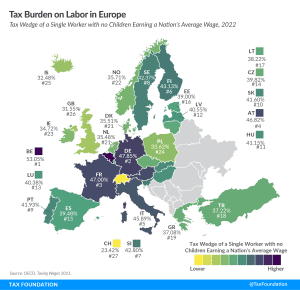

Reliance on Individual Income Tax Revenue in Europe, 2021

Source : taxfoundation.org

European Tax Maps Archives | Tax Foundation

Source : taxfoundation.org

Top Personal Income Tax Rates in Europe | Tax Foundation

Source : taxfoundation.org

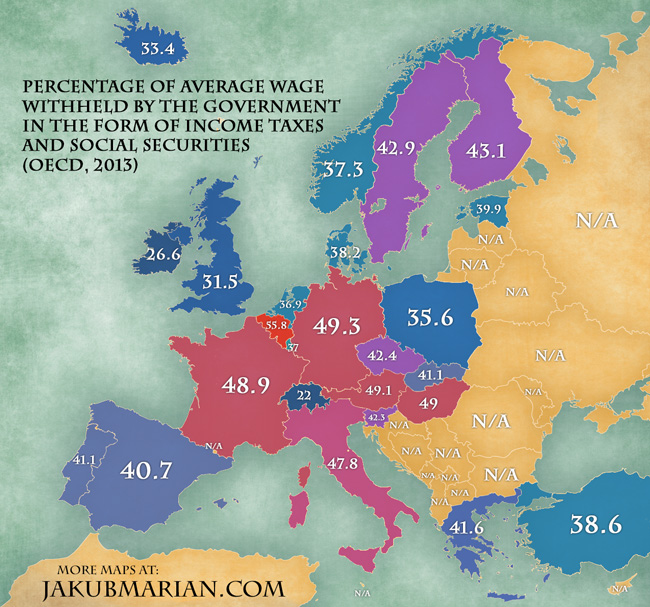

Map of income taxes and social security contributions by country

Source : jakubmarian.com

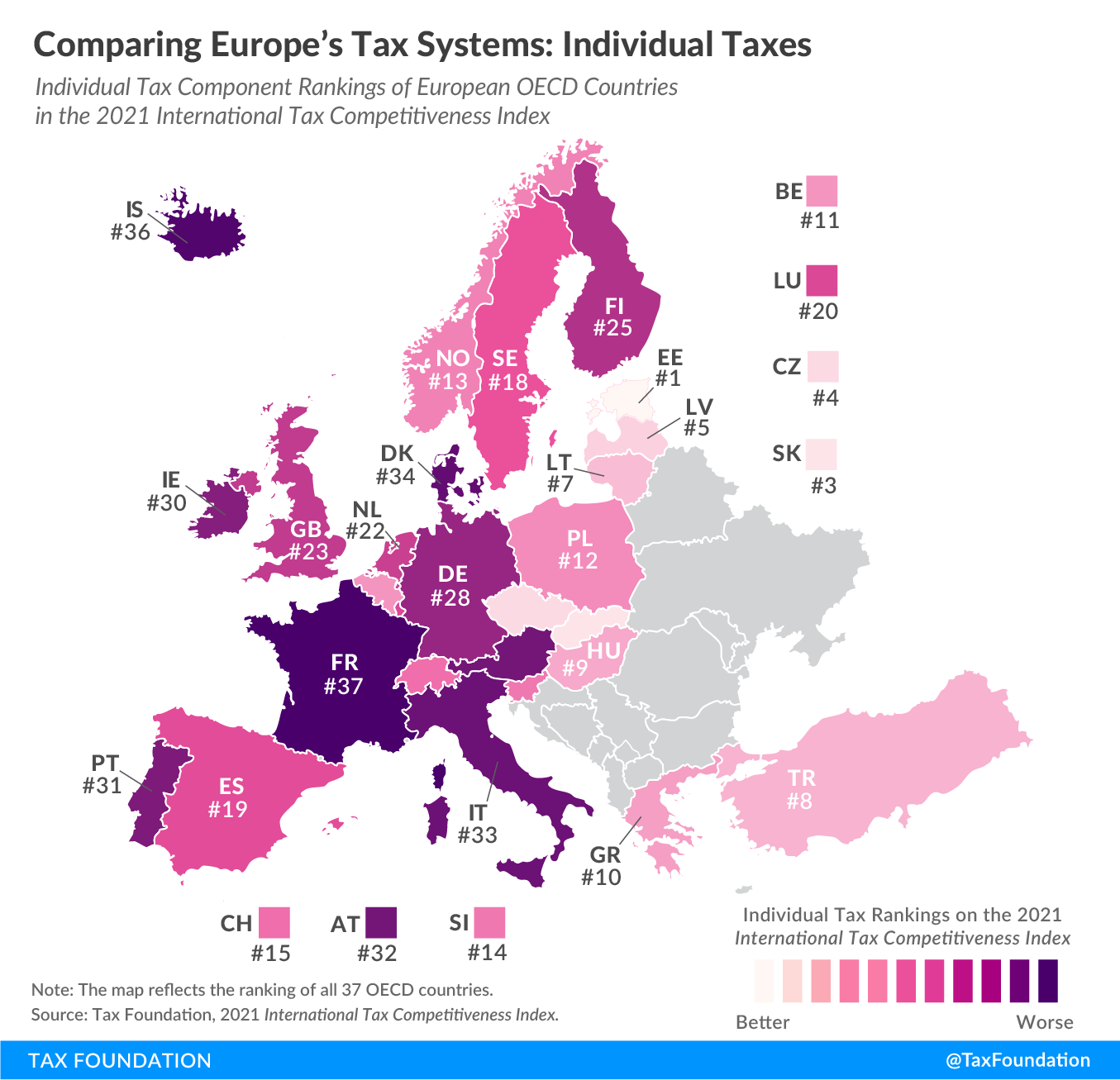

Comparing Income Tax Systems in Europe, 2021 | Tax Foundation

Source : taxfoundation.org

Map of individual Income Tax Rates in Europe. (Estonians please

Source : www.reddit.com

Income Tax Map Europe Top Personal Income Tax Rates in Europe, 2022 | Tax Foundation: And for some, these changes could impact how much tax is withheld from your paycheck. For 2024, federal income tax brackets and the standard deduction are both increasing. This change is in . When is the latest? Have the income brackets changed? What about deductions? Here are answers to 13 common questions that crop up in the weeks before tax season begins. April 15. Tax Day always .